oklahoma sales tax car purchase

125 sales tax and 325 excise tax for a total 45 tax rate. Standard vehicle excise tax is assessed as follows.

Sales Taxes In The United States Wikipedia

WE ARE NOT THE DMV.

. Learn more about OK vehicle tax obtaining a bill of sale transferring vehicle ownership and more. FORMS FOR NEW MOTOR VEHICLE DEALERSHIPS. The county the vehicle is registered in.

Buying a car or truck could soon cost Oklahomans a little more money. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Multiply the vehicle price after trade-ins and incentives.

325 of the purchase price or taxable value if different Used. 325 percent of the purchase price. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

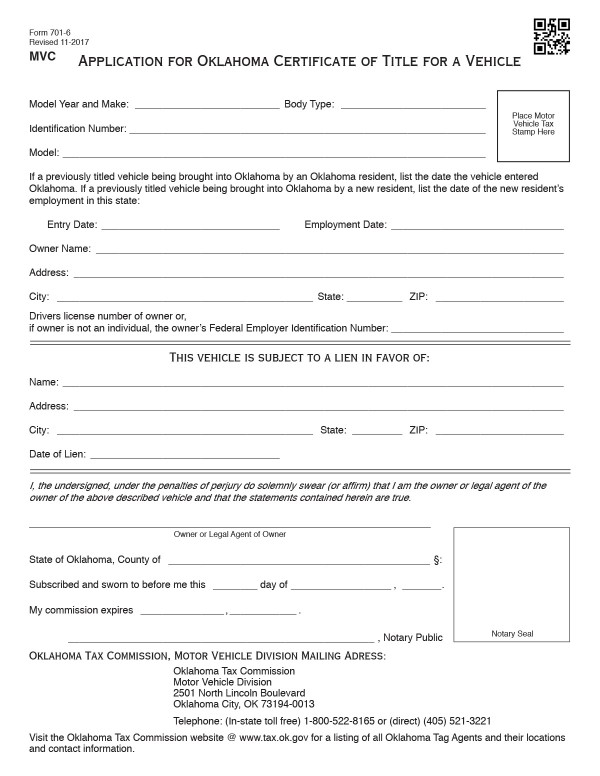

Oklahoma Tax Commission - Motor Vehicle Division Declaration of Vehicle Purchase Price This form is for the purpose of establishing the purchase price of a vehicle. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. An example of an item that exempt from Oklahoma is.

Multiply the vehicle price before trade-in or incentives by the sales. In Oklahoma this will. What is the tax on a new car in Oklahoma.

Typically the tax is determined by. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. In Oklahoma this will always be 325.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. If Senate Bill 1619 is signed into law and you buy a car for 15000 but trade in your vehicle for a 10000 credit you would only have to pay sales tax on the 5000 you. Get the facts before buying or selling a car in Oklahoma.

Oklahoma Sales Tax Rate 2022 Oklahoma charges two taxes for the purchase of new motor vehicles. How To Calculate Oklahoma Sales Tax On A New Car. Used vehicles are taxed a flat fee of 20 on the first 1500.

The minimum is 725. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Oklahoma Sales Tax on Car Purchases.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Oklahoma charges two taxes for the purchase of new motor vehicles. Counties and cities can charge an.

This form may also be. WE DO NOT ISSUE DRIVER LICENSES OR DRIVING RECORDS. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Oklahoma also has a vehicle excise tax as follows. Complete the Sales Tax Exemption PermitOTC Sales Tax Letter information below. The Senate passed a bill Friday that would impose a new 125 percent sales tax charge on the.

That is handled by Dept of Public Safety. 20 on the first 1500 plus 325 percent on the remainder. This is the largest of Oklahomas selective.

Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. 2 Upon application of a 100. OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. An average value for all such model vehicles is utilized. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Of exemption from assessment of Oklahoma vehicle sales tax. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle.

Sales Tax Relief From Liability In Oklahoma Mcafee Taft

What New Car Fees Should You Pay Edmunds

New Used Chevy Vehicles In Bartlesville Patriot Chevrolet

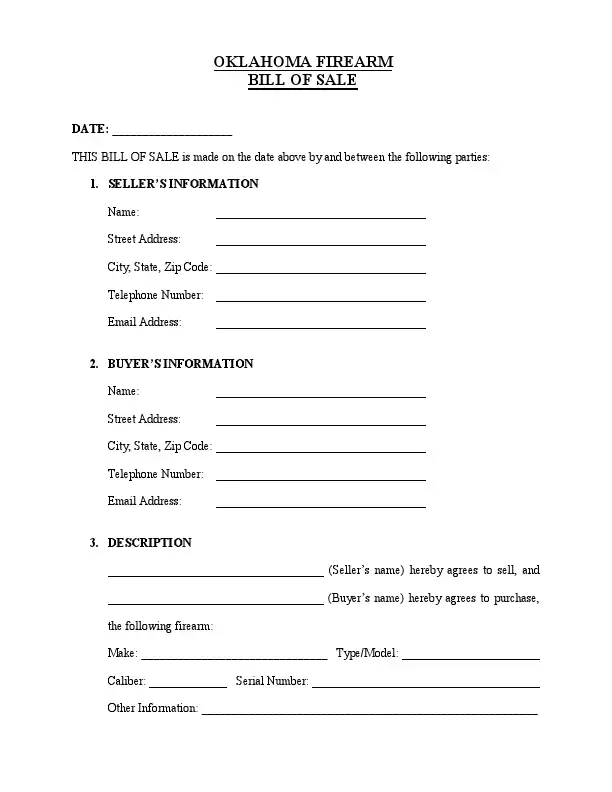

Free Oklahoma Bill Of Sale Templates Formspal Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Used 2018 Nissan Altima For Sale In Oklahoma City Ok With Photos Cargurus

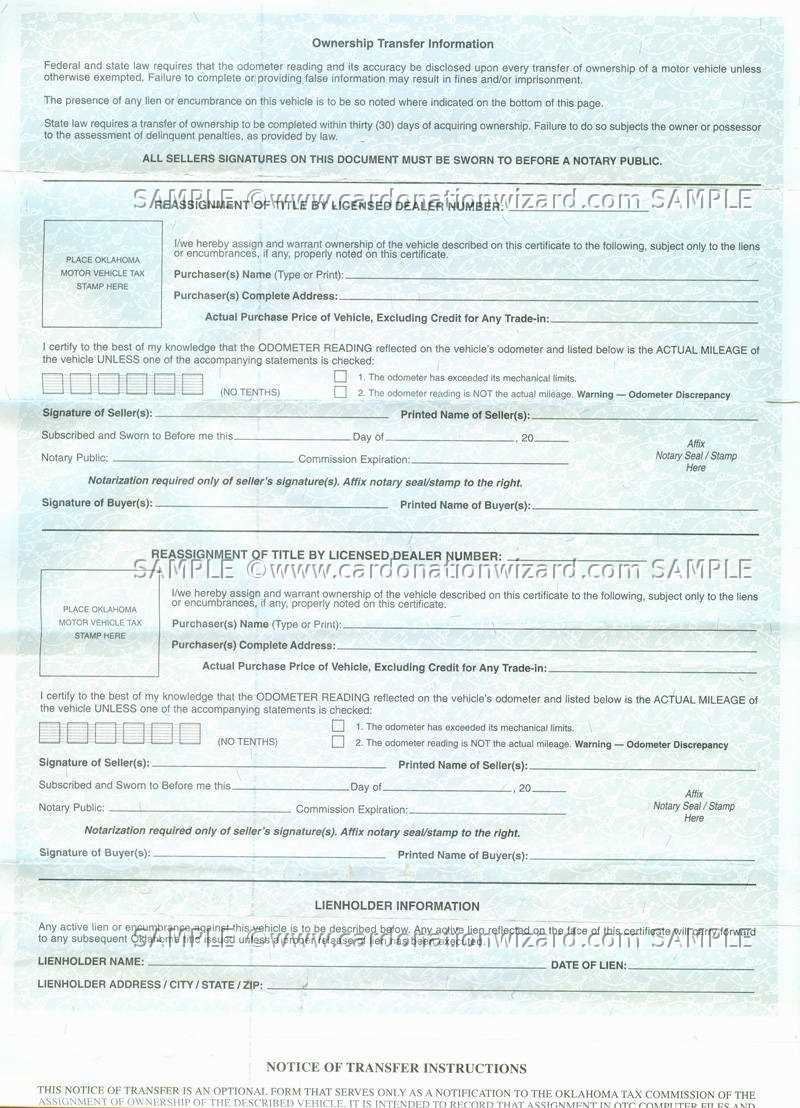

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices

Oklahoma Senate Passes Bills To Modify Vehicle Sales Tax Registrations Kokh

Used Cars And Trucks For Sale In Okc Bob Moore Auto Group

Oklahoma Drivers Must Carry Registration Starting July 1

If I Buy A Car In Another State Where Do I Pay Sales Tax

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Lawmakers Ok 1 25 Sales Tax On Cars

Smicklas Chevrolet Okc Chevy Dealership Service Center

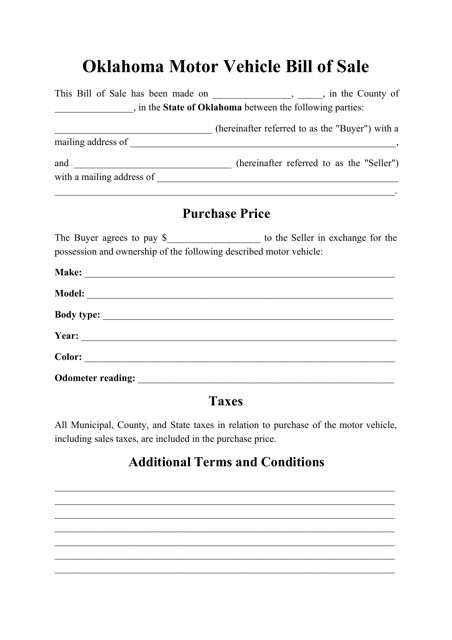

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Tulsa Ok Charity Car Donation Donate A Car In Tulsa Car Donation Wizard

Bills Of Sale In Oklahoma The Templates Facts You Need

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz